- SummerSouth Insider

- Posts

- 👨👨👦👦 Las Vegas Jewish Community Holds Vigil for Hostages Killed in Gaza

👨👨👦👦 Las Vegas Jewish Community Holds Vigil for Hostages Killed in Gaza

Issue #272 - September 4, 2024

Dear SummerSouth Insiders!

🚀Exciting News Ahead & We Need Your Support!🌟

Hello, amazing subscribers! We're gearing up for some thrilling developments and can't wait to share them with you! But here's the thing – we need a little boost from our most valued members: You! 🙌

Here's How You Can Make a Huge Impact:

💌Spread the Word: If you love our daily newsletter, why not share it? Whether it's family, friends, neighbors, or the friendly faces running local businesses – if you think they'll enjoy our content as much as you do, let them know! Your recommendation means the world to us and helps our community grow.

👍 Join Us on Facebook: Ready for more engaging content? Simply visit our Facebook page at SummerSouth Insider and hit that 'Like'

and ‘Follow’ button! It's a click away but makes a massive difference. Plus, you'll be in the loop for exclusive updates and conversations!

Your support is the backbone of our journey. Together, let's build a community where everyone benefits from insightful, daily content. Thank you for being a part of our exciting path forward! 🌈💪

Funeral Advantage Plan

There’s a new low cost final expense insurance plan available for seniors between 50-85. This plan can cover all of your final expenses:

✅burial

✅cremation

✅flowers

✅viewing

✅caskets

✅urns, and so much more.

To learn more, watch here.

Apply NOW to lock in your low rate. Rates will go up as you age. The sooner you act, the sooner you'll save!

📆 Weekly Local Events for September 2024

Regular weekly events in or near Summerlin, Las Vegas are listed below.

Visit here to lookup specific venue information or for upcoming and/or non-weekly events on Meetup.

Monday

Monday Classes At Latin Blendz: (Every week on Monday @ 10AM)

Socially Vegas - Monday Night Bowling @ The Orleans Bowling Center: Must arrive/check-in before 7pm; 7 - 10pm (Every week on Monday); COST (CASH Only) $10 for 2 games (includes shoes) COST: $12 for 3 games (includes shoes)

Monday Night TRIVIA at ReBAR, 1225 S Main St, Las Vegas: (Every week on Monday @ 7PM)

Tuesday

Terrific Tuesday Fun Pickleball @ Police Memorial, Bring a Chair: (Every week on Tuesday @ 2PM)

Sand Volleyball Intermediate, Rusty and Old Time Players @ Aloha Shores Park (NW), Cheyenne & Buffalo, 7550 Sauer St, Las Vegas: (Every week on Tuesday @ 6 - 8 PM)

Run Drink Las Vegas - Weekly Tuesday Run @ Frankie’s Uptown patio: 6:30 - 8:30 PM (Every week on Tuesday), FOLLOW US ON INSTAGRAM @rundrinklv FOR THE LATEST WEATHER/TIMING UPDATES

Coed Soccer - Summerlin: Crossings Park, 1111 Crestdale Ln, Las Vegas: 7:30 - 9:45 PM (Every week on Tuesday/Thursday)

Wednesday

Business Leads Group - Networking Breakfast @ Summit Restaurant, Eagle Crest Golf Course, 2215 Thomas W Ryan Blvd, Las Vegas: Cost $20 cash, 7 - 8:30 AM (Every week on Wednesday)

Early Risers Toastmasters Meeting (In-Person - Summerlin Egg Works / Online Event: 7 - 8 AM (Every week on Wednesday)

Las Vegas Valley Bicycle Club - Wednesday Morning Ride @ Einstein Bagels: 9 - 11:30 AM (Every week on Wednesday)

Speakers & Leaders of Summerlin Toastmasters Meeting, Summerlin Egg Works, 2025 Village Center Cir, Las Vegas: 12 - 1:30 PM (Every week on Wednesday)

Live Music Yoga w/ Cheryl Slader @ Blue Sky Yoga: (Suggested Donation $12); 5:30 - 6:45 PM (Every week on Wednesday)

Country Crossroads Dance, Rhythms Dance Studio & Event Center, 4545 W Sahara Ave, Las Vegas: $15 Drop-in Rate / $50 for the whole month: 8 - 9 PM (Every week on Wednesday)

Thursday

Abundance Business Networking Group Online Event: 7 - 8:30 AM (Every week on Thursday). Please arrive 10-15 minutes early for networking. Steps to access our BNI Online™ Virtual Chapter Meeting, visit website.

Las Vegas Real Estate Investors Association - Weekly Power Lunch For Real Estate Investors: 11 AM - 1 PM (Every week on Thursday). Request to join here.

Free Salsa Classes @ Feel The Music Dance Studio: 7 - 8 PM (Every week on Thursday). Visit the website to register online.

Summerlin Bitcoin Happy Hour, SG Bar, 9580 W Flamingo Rd, Las Vegas: 6:30 PM (Every week on Thursday)

Coed Soccer - Summerlin: Crossings Park, 1111 Crestdale Ln, Las Vegas: 7:30 - 9:45 PM (Every week on Tuesday/Thursday)

Friday

Find Your Yoga Las Vegas - Flow & Yin W / Noé Hilyard @ Yoga Sanctuary: 6 - 7:15 PM (Every week on Friday) View Yoga Sanctuary's full schedule.

Swing Dancing in Las Vegas Vintage and Modern Swing Dances @ The Mint Tavern: 7:30 - 8:30 PM (Every week on Friday)

Saturday

Vino Las Vegas Wine & Yacht Club Brunch: 9 AM - 2 PM (Every Saturday and Sunday)

Find Your Yoga Las Vegas - Saturday Morning Meditation with Practitioner Selina Kelly @ Yoga Kandy, LLC. Cost: Love Donation $5-$10 suggested. 11 - 11:45 AM (Every week on Saturday)

Sunday

Las Vegas Valley Bicycle Club - Sunday Morning Ride @ Einstein Bagels: 9 - 11:30 AM (Every week on Sunday)

Vino Las Vegas Wine & Yacht Club Brunch: 9 AM - 2 PM (Every Saturday and Sunday)

Level 1 West Coast Swing @ 2580 N Rancho Dr, North Las Vegas: 7 - 8 PM (Every week on Tuesday); Drop in Rate is $15, Monthly pass is $50; Register online.

⛽ Las Vegas Gas Prices

👨👨👦👦 Las Vegas Jewish Community Holds Vigil for Hostages Killed in Gaza

With heavy hearts, members of Las Vegas’ Jewish community gathered Monday night to mourn the loss of six Israeli hostages found dead in a tunnel in Gaza. The vigil, organized by Jewish Nevada and the Israeli American Council, took place at a community center in Summerlin, where attendees lit candles, prayed, and sang in remembrance of the victims. The hostages, captured during Hamas’ October 7 terrorist attack, were identified as Hersh Goldberg-Polin, Ori Danino, Eden Yerushalmi, Almog Sarusi, Alexander Lobanov, and Carmel Gat.

Stefanie Tuzman, president of Jewish Nevada, expressed the deep pain shared by the community. “I can’t find the words to express the pain of seeing such brutality,” she said. “My heart is shattered.” The vigil emphasized solidarity with Israel and the call for the release of the remaining hostages still held in Gaza.

Attendees like Sheila Taube highlighted the importance of communal grief, noting that "sadness and grief shared is easier to bear." Others, such as Las Vegas attorney David Chesnoff, stressed that the responsibility lies with Hamas to release the hostages.

As the community mourned, candles were lit in memory of the six hostages, who were remembered for their unique lives, passions, and bravery. The deaths have intensified calls in Israel for a cease-fire to bring remaining captives home, sparking both protest and debate.

Key Points:

Vigil Held for Hostages: The Las Vegas Jewish community held a vigil to honor six Israeli hostages found dead in Gaza.

Calls for Solidarity: Community leaders called for continued support for Israel and demanded the release of the remaining hostages.

Remembering the Victims: The hostages were remembered for their unique contributions to their families and communities.

Cease-fire Debate: In Israel, the deaths have sparked protests calling for a cease-fire to secure the release of more hostages.

Political Support: Local political figures, including Las Vegas Councilwoman Victoria Seaman, attended the vigil to express solidarity with the Jewish community.

🏈 Raiders 2024-2025 Regular Season Breakdown: Dates, Matchups, and Storylines

The Las Vegas Raiders’ 2024-2025 season kicks off with a challenging 17-game schedule. From familiar divisional rivalries to intriguing matchups with AFC and NFC powerhouses, here’s a detailed look at each game, including dates, times, TV details, betting lines, and key storylines.

Week 1: at Los Angeles Chargers

Date/Time: Sunday, Sept. 8, 1:05 p.m. (CBS)

Line: Chargers -3

All-time record: Raiders lead 69-58-2

Last meeting: Raiders 63-21 (Dec. 14, 2023)

Storyline: Jim Harbaugh debuts as the Chargers' head coach, while new Raiders GM Tom Telesco faces his former team.

Week 2: at Baltimore Ravens

Date/Time: Sunday, Sept. 15, 10 a.m. (CBS)

Line: Ravens -7½

All-time record: Ravens lead 9-4

Last meeting: Raiders 33-27 (OT) (Sept. 13, 2021)

Storyline: The Raiders face another Harbaugh—John. Slowing down MVP Lamar Jackson will be a key challenge.

Week 3: vs. Carolina Panthers

Date/Time: Sunday, Sept. 22, 1:05 p.m. (CBS)

Line: Raiders -4

All-time record: Raiders lead 4-3

Last meeting: Raiders 34-30 (Sept. 13, 2020)

Storyline: Bryce Young enters his second season with an improved supporting cast as the Raiders aim for a home win.

Week 4: vs. Cleveland Browns

Date/Time: Sunday, Sept. 29, 1:25 p.m. (CBS)

Line: Browns -2½

All-time record: Raiders lead 17-10

Last meeting: Raiders 16-14 (Dec. 20, 2021)

Storyline: Raiders fans face the Dawg Pound invasion as former wide receiver Amari Cooper returns with the Browns.

Week 5: at Denver Broncos

Date/Time: Sunday, Oct. 6, 1:05 p.m. (FOX)

Line: Broncos -1

All-time record: Raiders lead 73-54-2

Last meeting: Raiders 27-14 (Jan. 7, 2024)

Storyline: Rookie QB Bo Nix takes the reins in Denver, offering hope after the Russell Wilson experiment.

Week 6: vs. Pittsburgh Steelers

Date/Time: Sunday, Oct. 13, 1:05 p.m. (CBS)

Line: Steelers -1

All-time record: Raiders lead 17-15

Last meeting: Steelers 23-18 (Sept. 24, 2023)

Storyline: A tough matchup awaits the Raiders as the Steelers’ defense and QB Wilson, holding off Justin Fields, look to dominate.

Week 7: at Los Angeles Rams

Date/Time: Sunday, Oct. 20, 1:05 p.m. (CBS)

Line: Rams -4½

All-time record: Raiders lead 8-7

Last meeting: Rams 17-16 (Dec. 8, 2022)

Storyline: The Raiders face a Rams team without Aaron Donald, making the matchup slightly easier for their offense.

Week 8: vs. Kansas City Chiefs

Date/Time: Sunday, Oct. 27, 1:25 p.m. (CBS)

Line: Chiefs -5½

All-time record: Chiefs lead 73-55-2

Last meeting: Raiders 20-14 (Dec. 25, 2023)

Storyline: A rematch of last Christmas’ upset win over the Chiefs, but this time, the Raiders hope to spoil Kansas City's season early.

Week 9: at Cincinnati Bengals

Date/Time: Sunday, Nov. 3, 10 a.m. (FOX)

Line: Bengals -7

All-time record: Raiders lead 21-13

Last meeting: Bengals 26-19 (Jan. 15, 2022)

Storyline: Joe Burrow and a healthy Bengals squad present a big challenge, especially in cold November weather.

Week 11: at Miami Dolphins

Date/Time: Sunday, Nov. 17, 10 a.m. (CBS)

Line: Dolphins -6½

All-time record: Raiders lead 21-20-1

Last meeting: Dolphins 20-13 (Nov. 19, 2023)

Storyline: Mike McDaniel’s innovative Dolphins offense faces Raiders defensive coordinator Patrick Graham, who stifled them last season.

Week 12: vs. Denver Broncos

Date/Time: Sunday, Nov. 24, 1:05 p.m. (CBS)

Line: Raiders -3

All-time record: Raiders lead 73-54-2

Last meeting: Raiders 27-14 (Jan. 7, 2024)

Storyline: The Raiders return home as Formula One takes over Vegas, with the team favored against the Broncos.

Week 13: at Kansas City Chiefs

Date/Time: Friday, Nov. 29, Noon (Amazon Prime)

Line: Chiefs -7½

All-time record: Chiefs lead 73-55-2

Last meeting: Raiders 20-14 (Dec. 25, 2023)

Storyline: The Raiders look to spoil Black Friday for the Chiefs after last season’s Christmas upset.

Week 14: at Tampa Bay Buccaneers

Date/Time: Sunday, Dec. 8, 10 a.m. (CBS)

Line: Buccaneers -3

All-time record: Raiders lead 7-4

Last meeting: Buccaneers 45-20 (Oct. 25, 2020)

Storyline: The Raiders face Baker Mayfield and a tough Buccaneers defense, their eighth game against a 2023 playoff team.

Week 15: vs. Atlanta Falcons

Date/Time: Monday, Dec. 16, 5:30 p.m. (ESPN)

Line: Falcons -1

All-time record: Falcons lead 8-7

Last meeting: Falcons 43-6 (Nov. 29, 2020)

Storyline: Monday Night Football returns to Allegiant Stadium as the Raiders hope to keep playoff hopes alive.

Week 16: vs. Jacksonville Jaguars

Date/Time: Sunday, Dec. 22, 1:25 p.m. (CBS)

Line: Jaguars -1

All-time record: Jaguars lead 6-4

Last meeting: Jaguars 27-20 (Nov. 6, 2022)

Storyline: The Raiders face a potential AFC Wild Card showdown as Jacksonville eyes a playoff spot.

Week 17: at New Orleans Saints

Date/Time: Sunday, Dec. 29, 10 a.m. (FOX)

Line: Saints -3

All-time record: Series tied 7-7-1

Last meeting: Saints 24-0 (Oct. 30, 2022)

Storyline: A reunion with former QB Derek Carr as the Raiders face off against their ex-leader and former coach Dennis Allen.

Week 18: vs. Los Angeles Chargers

Date/Time: Jan. 4 or 5, TBD

Line: Chargers -1

All-time record: Raiders lead 69-58-2

Last meeting: Raiders 63-21 (Dec. 14, 2023)

Storyline: The regular season finale against the Chargers could have major playoff implications.

The Raiders’ season will be filled with exciting matchups, critical divisional games, and high-stakes contests as they aim to compete for a playoff spot. Keep an eye on key games against division rivals and strong AFC contenders like the Ravens, Bengals, and Dolphins.

❎ Trump’s Tariffs and Tax Cuts vs. Harris’ Housing and Parent Tax Credits in 2024 Race

As the 2024 presidential election approaches, Donald Trump and Kamala Harris are sharpening their economic platforms, each offering starkly different visions for the country’s financial future. Both candidates are vying for the support of the middle class, a group that has historically played a decisive role in presidential elections. Their proposals highlight contrasting philosophies on taxation, economic growth, government spending, and how best to tackle the challenges facing working families.

Trump’s Vision: Tax Cuts and Tariffs to Spur Growth

Donald Trump is betting on a strategy that emphasizes sweeping tax cuts and protectionist tariffs, aiming to stimulate investment and boost the U.S. economy. He’s proposing to extend the 2017 tax cuts, which are set to expire in 2025, as a central plank of his platform. Under his plan, Trump would keep the corporate tax rate low, potentially cutting it further from 21% to 15%. He’s also proposing to eliminate federal taxes on tips and Social Security income, positioning himself as a champion of workers and retirees.

Trump argues that his tax cuts, particularly those targeting businesses and the wealthy, will lead to increased investment, higher wages, and stronger economic growth. His advisers project that average annual growth could exceed 3%, a level the U.S. economy never consistently reached during Trump’s first term. However, Trump’s 2017 tax cuts did see some success for the middle class—between 2018 and 2019, median household income rose by $5,220 to $78,250, adjusted for inflation. Supporters of Trump’s policies point to this growth as evidence that cutting taxes for corporations and high-income earners can lift middle-class incomes.

Joseph LaVorgna, who served as an economist in Trump’s White House, emphasized the former president’s focus on re-industrializing the U.S. economy. “The Trump policies were designed to lift middle-class wages, re-onshore, and re-industrialize,” LaVorgna said. “The intention is to get wages higher.”

However, critics argue that the benefits of Trump’s tax cuts have disproportionately favored the wealthy and large corporations, while adding significantly to the national debt. Extending these cuts, along with Trump’s other tax proposals, would add an estimated $6 trillion to the federal deficit over the next decade. The Congressional Budget Office (CBO) already projects a $22 trillion deficit by 2033 under current policies, meaning Trump’s plans could push the deficit even higher.

Trump is also advocating for a substantial increase in tariffs, proposing a broad 10% tax on imports, with even higher rates of up to 20% or more on goods from countries like China. Trump argues that these tariffs would protect American jobs by making foreign products more expensive, encouraging domestic manufacturing. However, tariffs function as a form of tax on consumers, raising prices for imported goods. The Harris campaign claims that a 20% tariff would cost the average American household an additional $4,000 per year.

While Trump insists his tariffs wouldn’t exacerbate inflation, the economic goal of such a policy is to increase the price of imports, which could have inflationary effects. If implemented, the tariffs would likely phase in gradually to avoid economic shocks, but Trump has not provided details on how he plans to balance tariff revenues with his ambitious tax cuts.

Harris’ Vision: Taxing the Wealthy to Support Families and Housing

Kamala Harris, the Democratic nominee, is taking a vastly different approach, one focused on targeted investments in middle-class families, housing, and small businesses. Harris’ economic platform builds on progressive principles, seeking to fund her initiatives by raising taxes on corporations and the ultra-wealthy.

Harris plans to increase the corporate tax rate from 21% to 28%, reversing part of Trump’s 2017 tax cuts. She also proposes a new tax on unrealized capital gains for individuals worth more than $100 million, an effort to ensure that the wealthiest Americans contribute more to federal revenues. These tax hikes would help fund her ambitious agenda, which includes addressing key issues like affordable housing, childcare, and support for entrepreneurs.

One of Harris’ major proposals is a $25,000 down payment assistance program for first-time homebuyers, aimed at making homeownership more accessible to middle-class families. Her housing plan also includes incentives to build 3 million additional homes over four years, a response to the housing shortage and rising prices that have plagued many parts of the country. This push to increase housing supply is designed to reduce home costs, a critical issue for middle-class Americans struggling to afford homes.

In addition, Harris is proposing significant tax credits for parents, including a $6,000 tax credit for new parents and an expanded child tax credit. These measures are intended to help families cope with the high costs of raising children, especially in the wake of inflation that reached a 40-year high in 2022. Harris’ message is clear: by providing direct financial support to middle- and working-class families, her administration would help more Americans achieve financial stability and economic mobility.

“When working- and middle-class Americans have the opportunity to earn more, build a business, buy a home, and climb the economic ladder, it strengthens our economy and helps us grow,” said Brian Nelson, a Harris campaign adviser.

Harris’ proposals are designed to be fully funded, with her campaign suggesting that the revenue increases from tax hikes would offset the costs. The Penn Wharton Budget Model estimates that her tax proposals would raise $1.1 trillion by increasing corporate taxes and targeting high-net-worth individuals. However, Harris’ policies would still add $2.3 trillion in spending over a decade, according to the same analysis, and some of her plans, such as the tax on unrealized capital gains, lack sufficient detail to provide a precise revenue forecast.

Contrasting Views on Deficits and Debt

The issue of federal debt looms large in both candidates’ platforms. Trump, unconcerned by rising deficits, believes his tax cuts will generate enough economic growth to mitigate the costs. He is betting that his supply-side economic approach will boost overall revenue and that the additional debt is a price worth paying for the potential growth. However, independent analyses, including one from the Committee for a Responsible Federal Budget, suggest that Trump’s tax cuts would have little effect on growth and would significantly worsen the deficit.

Harris, by contrast, is more cautious about the deficit. Her team has stated that her policies would be fully funded, though there are questions about whether her tax proposals would generate enough revenue to cover the full scope of her spending plans. Still, Harris is taking a more balanced approach by aligning her spending priorities with new revenue sources, even if it means slower growth projections compared to Trump’s plans.

Impact on the Middle Class: Different Winners and Losers

Both candidates aim to improve the economic well-being of middle-class Americans, but their policies would affect different groups. Under Trump’s plan, the top 0.1% of earners would see an average tax savings of $376,910, while the poorest 20% of households would receive a modest benefit of $320. Harris’ policies, on the other hand, would shift more resources to lower- and middle-income families. The bottom 20% would see an average income increase of $2,355, while the wealthiest Americans would face higher taxes, with the top 0.1% losing $167,225 in after-tax income.

“Bigger picture: both Harris and Trump are causing the debt path to rise even faster than the fast pace under current law,” said Kent Smetters, faculty director of the Penn Wharton Budget Model. The choice between the two candidates presents a clear philosophical divide over the best way to manage the economy, taxes, and the middle class’s financial future.

Conclusion: A High-Stakes Economic Showdown

As Trump and Harris head into the 2024 election, their contrasting economic visions will likely be a focal point of the campaign. Trump is betting on deep tax cuts and tariffs to reignite growth, while Harris is offering targeted tax relief and investments in housing and families, funded by higher taxes on the wealthy. The stakes are high, as the winner could reshape the federal tax code, influence the economy for years to come, and determine the direction of the middle class’s financial future.

With the first presidential debate looming, both candidates are sharpening their economic messages in an attempt to sway voters. As history has shown, the economy is often a decisive factor in presidential elections, and this year will likely be no different. Whether voters prefer Trump’s promise of growth through tax cuts or Harris’ focus on direct middle-class support, the outcome of the election will have a profound impact on the U.S. economy for years to come.

🎰 Tropicana Casino’s Impending Implosion Drives Up Room Rates for Nearby Hotels

Las Vegas is preparing for a historic moment as the Tropicana casino-hotel is set to be imploded on October 9 at 2:30 a.m., pending final approval from Clark County. This will be the first controlled demolition in Sin City in eight years. Before the blast, a fireworks and drone show will light up the sky on October 8, adding to the spectacle. The iconic Rat Pack-era casino will make way for a proposed $1.5 billion stadium for Major League Baseball's Oakland Athletics, along with a future resort development.

The anticipation surrounding the implosion has sent room rates soaring for properties with a view of the event. The nearby Oyo casino-hotel, located closest to the Tropicana, is charging between $549 and $567 for Strip-view rooms on the night of the demolition. MGM properties, including the MGM Grand, New York New York, and Excalibur, have also seen demand surge. Rooms at NYNY and Excalibur have already sold out, while the cheapest room at MGM Grand is listed at an eye-watering $1,550.

Properties further from the site are seeing similar spikes. Rooms at the Bellagio and Vdara, located about a mile away, are starting at $699 for the night of the event. The timing of the implosion coincides with the Global Gaming Expo (G2E), the largest annual gambling industry conference, which has traditionally driven up room rates on the Las Vegas Strip.

This will be the first Las Vegas casino implosion since the Riviera came down in 2016. The Tropicana demolition marks the end of another chapter in the city's vibrant history, as plans to build a new stadium and resort move forward, although funding for the project has not yet been finalized.

Key Points:

Tropicana Implosion Scheduled: The controlled demolition is set for Oct. 9, preceded by a fireworks and drone show on Oct. 8.

Hotel Room Rates Spike: Nearby hotels like Oyo, MGM Grand, Bellagio, and Vdara have dramatically increased rates, with some properties selling out.

Coincides with Global Gaming Expo: The implosion takes place during the G2E conference, adding to the demand for rooms.

Historic Moment: This will be the first Las Vegas casino implosion in eight years, with the Trop making way for a proposed $1.5 billion MLB stadium.

Summerlin South, NV Demographics

What is the population of Summerlin South?

What are the employment statistics in Summerlin South?

How many households are there in Summerlin South?

What are the median and average incomes in Summerlin South?

How many homeowners and renters are there in Summerlin South?

What is the level of education in Summerlin South?

What is the marital status of Summerlin South residents?

What are the most common means of transportation in Summerlin South?

Methodology & Disclaimers

Demographic data shown in this section was gathered from the latest U.S. Census Bureau release, the 2022 American Community Survey. The information is updated yearly, as soon as new data is made available by the US Census Bureau.

No representation, guarantee or warranty is made as to the accuracy or completeness of information modified or aggregated for specific neighborhoods and/or zip codes.

Zip codes included in this demographic data: 89135

Summerlin Area Command - Week Ending: August 30, 2024

Courtesy of The Las Vegas Metropolitan Police Department.

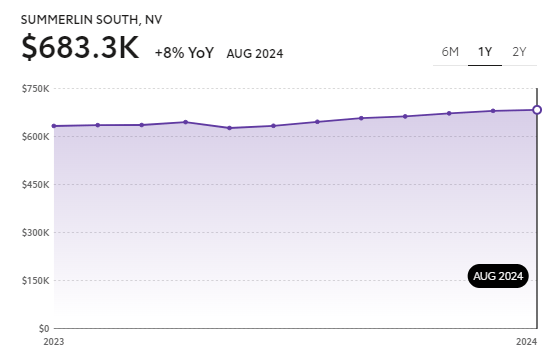

📌 🏠 Summerlin South - August 2024

*Median Sold Price By Bedroom Count

This is the middle price for which all homes in the area were sold based on the number of bedrooms. Half of all the homes sold were below this price, and half were above.

Visit here to see the entire report.

📌 ✅ We Want To Spotlight Your Business!

Would you like us to spotlight your local business in front of thousands of Summerlin South area residents in an upcoming issue of SummerSouth Insider?

We ❤️ Local Businesses!

We know our community is brimming with businesses that have fascinating stories and big hearts. If you're a local business owner making waves, crafting unique experiences, or simply putting a smile on our faces, we want to chat with you! "SummerSouth Insider" is eager to shine a light on the unsung heroes of our town. Let's collaborate and let the community know what makes your business special. Send us a message, and let's celebrate the spirit of Summerlin South together!

👇Select an option below:

✅Own a local Business? Apply to be featured.

📌 ✅ We Want Your Feedback!

We read your emails, comments, and poll replies daily.

Hit reply and tell us what you want more of!

Until next time, John Wu.